Add VAT info for a NETP

Hello,

I have an LTD in the UK (selling and storing goods in the UK) but I do live in France.

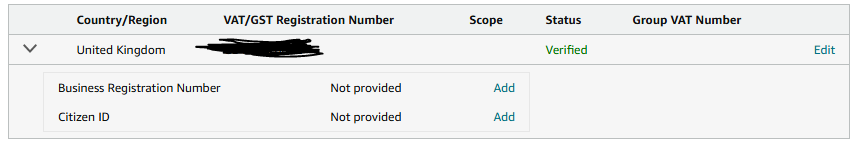

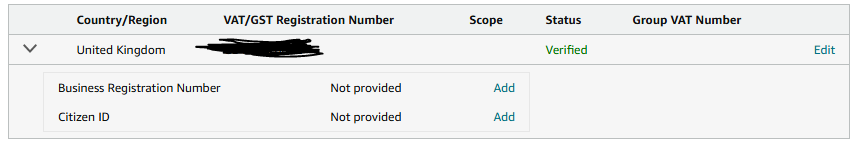

I would like to add my VAT info on amazon for the UK but when trying to fill them in they are asking me for a Citizen ID that I don't have because I live in France.

I also had to put my virtual address in the UK because they are not accepting my address in France stating that : "The address must match the country of your tax registration number. Please enter a valid address associated with this tax registration number. If you do not have an address in this country, you should use your primary business contact address."

My Business Registration Number is also not accepted and I don't know why.

Can someone help please?

Add VAT info for a NETP

Hello,

I have an LTD in the UK (selling and storing goods in the UK) but I do live in France.

I would like to add my VAT info on amazon for the UK but when trying to fill them in they are asking me for a Citizen ID that I don't have because I live in France.

I also had to put my virtual address in the UK because they are not accepting my address in France stating that : "The address must match the country of your tax registration number. Please enter a valid address associated with this tax registration number. If you do not have an address in this country, you should use your primary business contact address."

My Business Registration Number is also not accepted and I don't know why.

Can someone help please?

0 odpowiedzi

Seller_d8YGbIjNqwFxn

Your screenshot says your VAT number is verified so it should be on your Amazon account.

The business registration number and Citzen ID are not normally needed on this screen so normally you can leave blank. Unless there is a specific reason for adding them or a request from Amazon to add them.

Sarah_Amzn

Hello @Seller_Z707Qh3Vgbt68,

I'm Sarah with Amazon.

Are you still facing the issue or you managed to sort it out?

Kind regards,

Sarah.